- SimpliFi™ Marketing

- Seacomm Federal Credit Union

- Personal Loans

The Challenge

SeaComm FCU needed a scalable way to grow consumer loan volume during the most competitive borrowing season of the year — August through January — when members are heavily targeted by credit card issuers and high-interest lenders.

Traditional loan marketing requires applications, branch visits, and decision timelines that slow momentum. Meanwhile, members seeking fast access to funds often turn to costly alternatives.

SeaComm wanted to:

Drive meaningful loan growth

Compete with predatory and high-interest lenders

Provide a frictionless borrowing experience

The solution needed to be bold, seamless, and repeatable.

The Objective

To create a high-impact, pre-screened lending campaign that delivers immediate access to funds while reinforcing SeaComm’s reputation as a trusted financial partner.

Specifically, the campaign aimed to:

Generate measurable consumer loan growth

Remove application friction

Provide transparent, fixed-rate financing

Offer members a responsible alternative during high-spend seasons

Ensure full compliance with FCRA regulations

Each campaign reaches more than 11,000 qualified members, generating 500–700 funded loans per cycle — equating to approximately $1.5M–$2.1M in loan volume per campaign.

The Strategy

EmpowerFi™ developed a fully integrated Pre-Screen Live Marketing Check Campaign designed to eliminate friction and drive predictable loan growth.

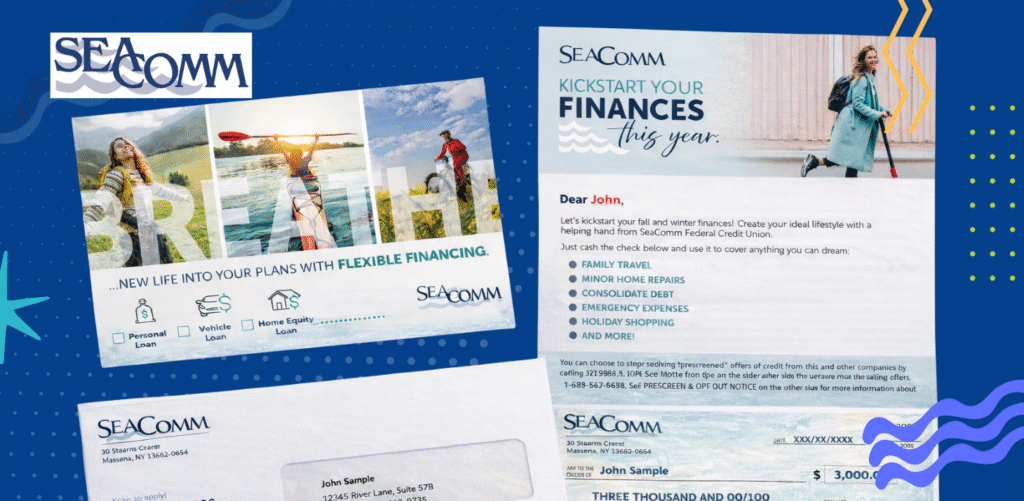

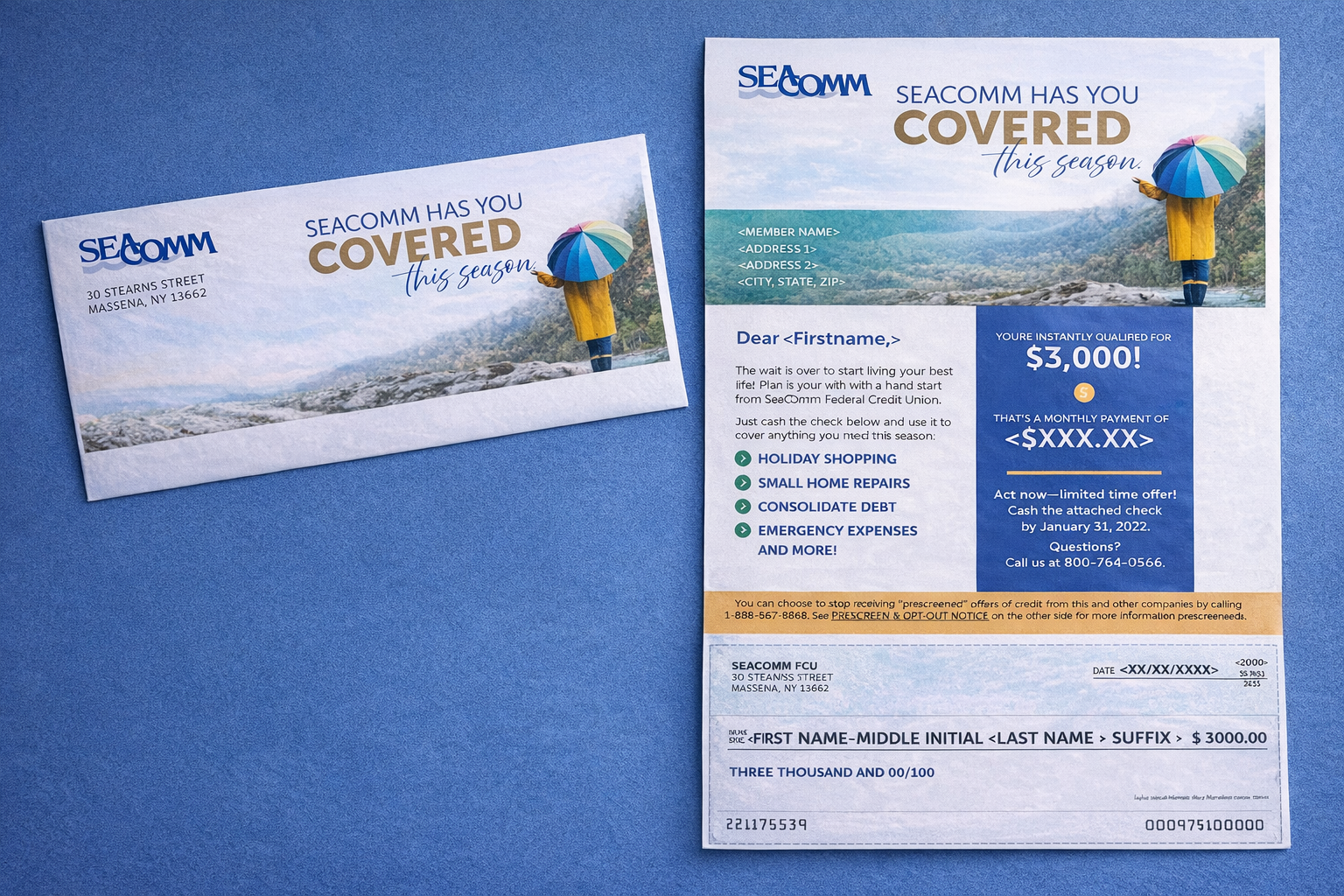

Qualified members receive a personalized credit offer with a perforated, negotiable live check printed on secure MICR stock. When deposited, the check activates the loan under clearly disclosed, fixed-rate terms — no application or branch visit required.

Members see their rate, term, monthly payment, and total interest upfront, ensuring full transparency and no hidden fees.

The campaign is executed in partnership with SeaComm and the credit bureau, incorporating FCRA-compliant language, secure check production, tinted envelopes, and coordinated processing oversight.

The result is a seamless, compliant, and highly effective lending engine that has delivered consistent results for nearly two decades.

Secure Live Check Mailer

Personalized prescreened credit offer

Perforated live check printed on secure stock with MICR ink

Clearly disclosed rate, term, payment amount, and total interest

Compliance language and opt-out verbiage

Direct Mail Sequence

2x reminder mailers to members who haven’t yet deposited their check

Reinforces urgency and seasonal timing

Extends campaign visibility

Boosts overall response rate

Digital Reinforcement

Follow-up email reminders to eligible members

Cohesive seasonal messaging alignment

Brand-consistent digital creative

Ensures repeated visibility and keeps the offer top-of-mind during peak borrowing months.

The Impact

For nearly two decades, this campaign has served as a reliable lending engine for SeaComm FCU.

With over $1.5M–$2.1M in funded loans per cycle, the Live Letter Check campaign:

Drives predictable consumer loan growth

Strengthens member relationships

Provides a responsible alternative to high-cost borrowing

Reinforces ease of doing business with SeaComm

It’s proof that when strategy, compliance, data, and creative align — direct mail can still outperform.

We absolutely love our live letter check campaigns! We've had so much success over the years and it helps to have a partner as knowledgeable as EmpowerFi on our side.

Tammy Harrigan

VP, Marketing @ Seacomm

Other Marketing Campaigns

Ready to get started?

Let’s craft marketing campaigns that get results.

Professional & Insight-Driven For Your Business

Stay up to date with strategies, trends, and ideas designed to help financial brands grow with confidence.